Understanding the Squeeze Momentum Indicator: A Trader’s Guide

Introduction to the Squeeze Momentum Indicator

The Squeeze Momentum Indicator (SMI) has gained considerable popularity among traders for its effectiveness in identifying potential price movements driven by market volatility. Developed by John Carter, this innovative tool is designed to highlight periods where the market is consolidating, often followed by significant price action. Traders are increasingly relying on the SMI as it provides valuable insights into entries and exits within dynamic market conditions.

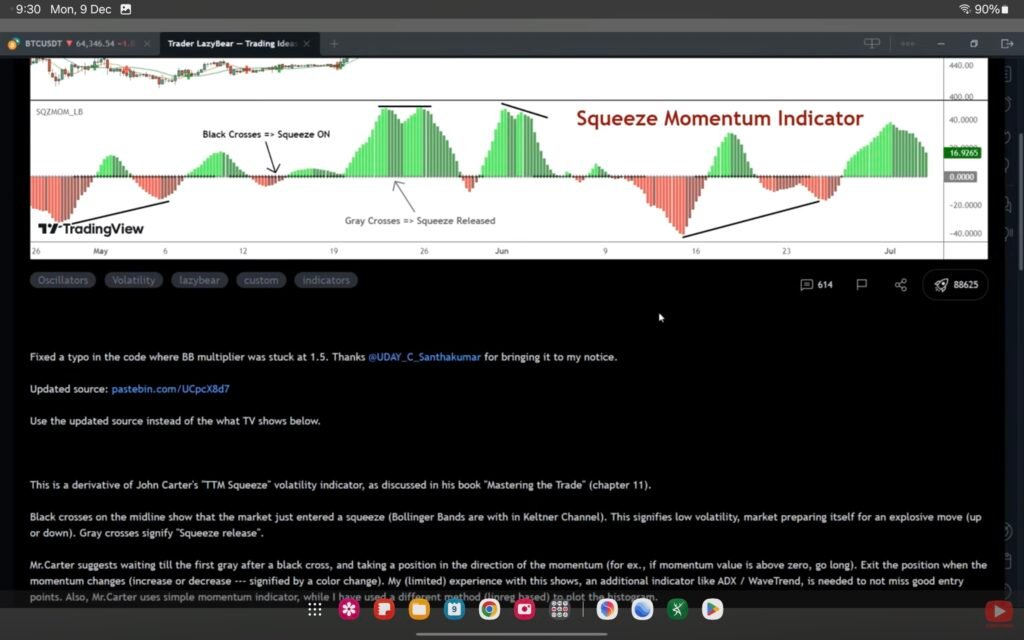

The primary purpose of the Squeeze Momentum Indicator is to pinpoint periods of low volatility, characterized by a “squeeze,” when price fluctuations are minimal. This is represented visually through a squeeze, denoting that the price is coiling before a potential explosive move. The SMI utilizes various components, such as Bollinger Bands and the Keltner Channels, to assess this dynamic—where Bollinger Bands represent volatility and Keltner Channels identify trending movements. By analyzing these indicators, traders can better forecast future price movements as the market transitions from a quiet phase to a more active one.

Furthermore, the Squeeze Momentum Indicator serves not only to signal potential breakouts but also assists traders in capturing trend reversals. The accompanying momentum histogram provides additional support, allowing traders to measure the strength and direction of the momentum. This comprehensive approach is essential for informed decision-making, ultimately empowering traders to optimize their strategies amidst the fluctuations of the market.

In summary, the Squeeze Momentum Indicator stands as a pivotal tool in the trading community, enhancing market analysis and decision-making processes through its capacity to highlight periods of volatility and trend shifts. As we explore its components and workings, it becomes evident how vital this indicator has become for both novice and experienced traders alike.

Components of the Squeeze Momentum Indicator

The Squeeze Momentum Indicator (SMI) is a valuable tool for traders, primarily constructed using two critical components: Bollinger Bands and Keltner Channels. Understanding these components is essential, as they play a significant role in measuring market volatility and price action. Bollinger Bands consist of a middle band that represents the simple moving average (SMA) and two outer bands that are defined by a set number of standard deviations from the SMA. This setup allows traders to gauge market volatility; tighter bands indicate lower volatility, while wider bands signal increased volatility.

Keltner Channels, on the other hand, are built around an exponential moving average (EMA) along with an upper and lower band that is typically set a specific multiple of the Average True Range (ATR) above and below the EMA. Similar to Bollinger Bands, Keltner Channels serve to measure volatility and help identify market trends. The interplay between these two indicators is fundamental to understanding the squeeze phase, which occurs when the Bollinger Bands contract and enter the Keltner Channels. This contraction implies that the price is consolidating and there is an impending increase in volatility.

When the bands and channels begin to expand after a period of contraction, it signifies a potential breakout either to the upside or downside. This movement is crucial for traders looking for opportunities to capitalize on significant price shifts. The SMI leverages these dynamics to provide a clearer picture of market conditions, guiding traders in making informed decisions. By monitoring the correlations between Bollinger Bands and Keltner Channels, traders can enhance their ability to predict significant price movements, placing them in a more advantageous position in the markets.

Understanding the Squeeze Momentum Signal

The Squeeze Momentum Indicator (SMI) is a powerful analytical tool used by traders to identify potential trading signals within financial markets. The primary function of the SMI lies in its ability to discern periods of market consolidation and momentum shifts, which can lead to profitable trading opportunities. The indicator typically produces two primary signals: buy signals and sell signals, each corresponding to specific market conditions.

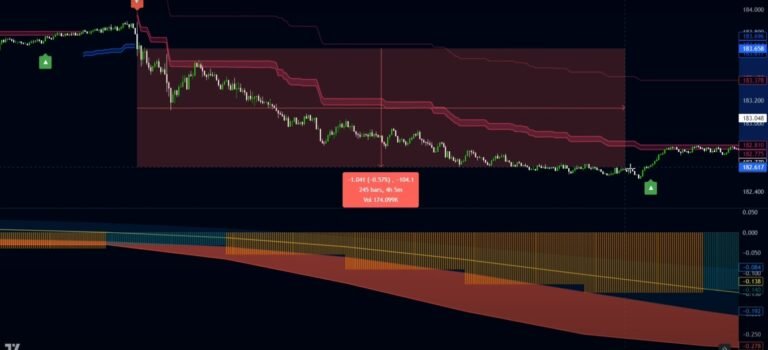

Buy signals are generated when the Squeeze Momentum Indicator identifies oversold conditions in the market. This occurs when the price action has been subdued within a certain range, leading to a potential buildup of energy ready to be released. The indicator represents this scenario with green bars, suggesting that market participants may soon experience upward momentum. This shift often signifies an opportunity for traders to enter long positions, ideally capturing profits as prices begin to rise.

Conversely, sell signals are indicated when the Squeeze Momentum Indicator detects overbought conditions. This situation often arises after a sustained price increase, signaling that the momentum may be slowing down or reversing. The SMI highlights these conditions with red bars, alerting traders to the potential for a downward price movement. Recognizing this signal can assist traders in making timely decisions to exit long positions or initiate short-selling strategies, thereby mitigating potential losses.

Overall, the Squeeze Momentum Indicator serves as an essential component of a trader’s toolkit, enabling better-informed decisions based on market momentum. By understanding the various signals this indicator produces, traders can enhance their ability to navigate market fluctuations effectively. Recognizing when to enter or exit a trade based on these signals can be pivotal in achieving consistent trading success.

Scalping Strategy Using the Squeeze Momentum Indicator

Scalping is a high-frequency trading strategy aimed at capitalizing on small price movements within a short time frame. Traders utilizing the Squeeze Momentum Indicator (SMI) in conjunction with the RMI Trend Sniper strategy can enhance their chances of making profitable trades. The SMI helps traders identify periods of low volatility that may precede significant price movements, offering optimal entry points for scalping operations.

For effective scalping, traders often choose short time frames, typically ranging from one to five minutes. This allows them to react quickly to market dynamics. As the Squeeze Momentum Indicator signals a potential breakout, traders can observe the accompanying RMI Trend Sniper to confirm the trend direction. A bullish pressure indicated by the SMI paired with an upward momentum identified by the RMI suggests a strong buying opportunity.

When identifying entry points, traders should look for the SMI transitioning from a squeeze phase into an expansion phase, signaling a potential price breakout. Once this occurs, confirming the trend direction with the RMI is essential. Entry orders can be placed just above the breakout level, usually set closely to the most recent swing high or low, providing a tight risk management framework.

Establishing exit strategies is equally crucial in scalping to secure profits swiftly while minimizing losses. Traders typically implement stop-loss orders just below the recent low for long positions or above the recent high for short positions, controlling risk effectively. Take-profit targets are often set at predetermined levels based on risk-reward ratios, such as 1:1 or 1:2, allowing traders to exit positions once a certain profit level is achieved.

Incorporating the Squeeze Momentum Indicator into a scalping strategy, combined with prudent risk management practices, can significantly improve trading performance and increase the likelihood of successful trades in fast-paced market conditions.

Swing Trading Strategy with the Squeeze Momentum Indicator

Swing trading stands out as an effective alternative trading strategy, especially for traders seeking to capitalize on short to medium-term market movements. The essence of swing trading lies in identifying price swings within a trend, which often involves waiting for clear breakouts or breakdowns after periods of consolidation. During these phases, it is crucial to employ tools that can help delineate potential entry and exit points, and this is where the Squeeze Momentum Indicator plays a pivotal role.

The Squeeze Momentum Indicator serves as a valuable companion for swing traders by providing visual cues regarding market volatility and potential price shifts. In scenarios where a stock or asset is undergoing a consolidation phase, the indicator can help identify moments when the market is likely to break out or break down. If the indicator shows a squeeze—a scenario where volatility is low and the price oscillates within a tight range—it suggests that a significant price movement might be approaching. Traders can interpret this as an opportunity to position themselves accordingly, preparing for either bullish or bearish trends.

Moreover, setting stop-loss and take-profit targets is essential for managing risk within swing trading strategies. A prudent approach necessitates placing stop-loss orders just beyond the established support or resistance levels. This safeguards against errant movements that could lead to substantial losses. Conversely, take-profit targets should be defined based on the trader’s risk-reward ratio, typically aiming for a minimum ratio of 1:2 to ensure a favorable return on investment.

By integrating the Squeeze Momentum Indicator into a swing trading strategy, traders can enhance their decision-making process, waiting for significant price movements that present high-probability trading signals. Maintaining discipline and employing sound risk management practices will ultimately contribute to a successful trading endeavor.

Important Considerations for Effective Trading

When utilizing the Squeeze Momentum Indicator (SMI), it is crucial for traders to keep several essential considerations in mind to enhance their trading effectiveness. One of the foremost aspects is the importance of backtesting strategies using historical data. By analyzing past market behaviors, traders can gauge the performance of their strategies and identify potential patterns that may repeat. This data-driven approach not only helps traders refine their methods but also boosts their confidence when deploying these strategies in live market conditions. Implementing rigorous backtesting protocols can ultimately lead to more informed trading decisions and a higher probability of success.

Additionally, managing risk is a critical component of effective trading. Traders should always incorporate stop-loss orders to protect their investments from significant downturns. A stop-loss order acts as a safety net, limiting potential losses by ensuring that a position is closed once it reaches a certain price. This not only helps in preserving capital but also alleviates emotional stress during trading, allowing traders to adhere to their strategies without succumbing to panic. Understanding the function of stop-loss orders and positioning them wisely is instrumental in successful trading practices when using the Squeeze Momentum Indicator.

Moreover, diversifying trading tools and indicators can offer traders a more comprehensive analytical framework. Relying solely on the SMI may limit one’s perspective on market movements. By integrating other technical indicators alongside the SMI, traders can gain a more holistic view of market conditions. Tools such as moving averages, Relative Strength Index (RSI), or Fibonacci retracement levels can provide additional confirmation signals, enhancing the overall trading strategy. Combining multiple indicators creates a more robust trading plan, ultimately leading to better decision-making in the ever-changing markets.

Assessing Market Conditions

Understanding how market conditions impact the effectiveness of the Squeeze Momentum Indicator (SMI) is crucial for traders looking to optimize their strategies. The SMI is designed to capture periods of low volatility that often precede price breakouts. However, when market conditions shift to high volatility or become sideways, the reliability of this indicator can be compromised. Therefore, it is essential for traders to adjust their approach according to current market trends.

In high volatility environments, the Squeeze Momentum Indicator may produce false signals. This is primarily due to rapid price fluctuations that can obscure the precursor patterns that traders rely on. For instance, during such times, price movements may oscillate wildly, making it challenging for the SMI to provide clear buy or sell signals. Traders can mitigate this risk by employing a wider confirmation range or incorporating additional indicators, such as the Average True Range (ATR), to assess volatility and refine their entry and exit points.

On the other hand, sideways market conditions present another challenge for the Squeeze Momentum Indicator. During these periods, price consolidation can cause the SMI to remain within tight ranges, leading to a prolonged state of ‘squeeze.’ While this can signal the potential for a breakout, traders must exercise caution, as these breakouts may not materialize promptly. To adapt, traders can utilize shorter time frames to further analyze price movements, or they may choose to combine the SMI with moving averages to identify dominant trends, thereby enhancing decision-making.

Overall, recognizing how varying market conditions affect the performance of the Squeeze Momentum Indicator is vital. By adopting flexible trading strategies that account for both high volatility and sideways markets, investors can enhance their ability to make informed trading decisions while harnessing the potential of the SMI.

Real-world Applications and Examples

The Squeeze Momentum Indicator has gained recognition among traders for its ability to provide critical insights into market conditions. This tool can reveal potential trade setups which offer enhanced risk-reward ratios. Understanding its application in real-world trading situations can help investors make more informed decisions. For instance, during periods of market consolidation, traders often rely on the Squeeze Momentum Indicator to identify upward or downward breakouts.

One notable example is the use of the Squeeze Momentum Indicator in the currency market. A trader may observe a tightening Bollinger Band alongside low momentum histogram values, indicating a potential squeeze phase. After a period of compression, if the price action breaks out significantly, traders can enter a position following the signal onset. For instance, if that breakout is bullish, entering a long position while setting a stop-loss slightly below the breakout point can be a smart approach. In this context, the Squeeze Momentum Indicator acts as a confirmation tool ensuring that traders capitalize on the heightened volatility.

Furthermore, the Squeeze Momentum Indicator is not limited to forex trading; it also proves beneficial in stocks and commodities. In a recent scenario involving a tech stock, the indicator signaled an impending breakout after the stock traded within a tight range for several weeks. When the histogram shifted from red to green, traders anticipated a bullish move and opened positions accordingly. This resulted in substantial gains as the stock surged past the resistance levels observed. The application of the Squeeze Momentum Indicator thus not only aids traders in identifying critical price movements but also helps in efficiently managing positions by highlighting key entry and exit points.

Conclusion: Enhancing Trading Outcomes with the Squeeze Momentum Indicator

In summary, the Squeeze Momentum Indicator serves as a powerful tool within a trader’s arsenal, offering significant potential for enhancing trading outcomes. By identifying periods of low volatility, the indicator allows traders to anticipate sharp price movements that could signify profitable opportunities. Understanding how to read the Squeeze Momentum Indicator equips traders with the ability to make informed decisions based on market conditions, increasing the likelihood of successful trades.

Moreover, the integration of this indicator into a trading strategy can support the identification of market trends and momentum shifts. By capitalizing on these insights, traders can optimize entry and exit points, thus improving their overall trading performance. The visual cues provided by the Squeeze Momentum Indicator — including the color changes in the histogram and the transition from squeezed to released states — further enhance a trader’s ability to react appropriately to market signals.

However, it is critical to acknowledge that trading involves inherent risks. The Squeeze Momentum Indicator, while beneficial, is not infallible. It is essential for traders to conduct thorough analysis and research, combining the Squeeze Momentum Indicator with other technical tools and fundamental analysis to mitigate risks effectively. This diversified approach can lead to better-informed trading decisions and improved risk management.

As traders explore the functionality and benefits of the Squeeze Momentum Indicator, they must remain vigilant and maintain a disciplined approach. Continuous learning and adaptation to the evolving market environment will prove invaluable in harnessing the full potential of this indicator. By doing so, traders can enhance their outcomes while navigating the complexities of the financial markets more effectively.