Harnessing the Power of the Range Filter Indicator in Trading

Introduction to the Range Filter Indicator

The Range Filter Indicator is a technical analysis tool utilized by traders to assess price movements and market conditions effectively. Its primary purpose is to filter out unnecessary price fluctuations, allowing traders to focus on significant price trends. In the context of trading, the range filter works by identifying and analyzing the volatility of an asset over a specified time period, enabling traders to make more informed decisions based on these insights.

This indicator operates on the principle that price movements can be classified as either trending or ranging. By employing the range filter, traders can distinguish between these two states, filtering out noise and highlighting more meaningful price action. Particularly in complex trading environments, the range filter becomes an instrumental part of a trader’s toolkit, assisting them in recognizing potential entry and exit points with greater precision.

Understanding How the Range Filter Indicator Works

The range filter indicator is a vital tool in the arsenal of traders seeking to capitalize on price movements in the financial markets. It functions by determining a defined price range, which typically represents the highest highs and the lowest lows over a specified period. This measure allows traders to assess the volatility and price stability of an asset, thus facilitating informed decision-making.

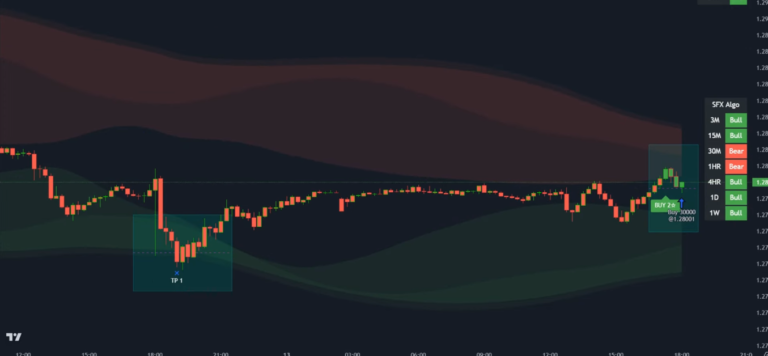

At its core, the range filter indicator operates on the principle of price breakouts. When the price exceeds the predefined boundaries of the range, it signals a potential buying opportunity, while a break below the range can indicate a selling signal. This breakout approach enables traders to identify significant market moves, aligning their strategies with the prevailing momentum. The ability of the range filter indicator to isolate these price extremes makes it an essential component in trend-finding methodologies.

Importantly, the initial signal generated by the range filter should not be acted upon in isolation. Traders are advised to confirm these signals with subsequent candles before executing a transaction. An additional confirmation can help to reduce false signals that may arise due to erratic price movements or market noise. Such an approach enhances the reliability of trading decisions, as it aligns entry points with the market’s true intent.

Moreover, combining the indicators with other analytical tools, such as moving averages or oscillators, can provide further confirmation of the trading signals. By applying this multi-faceted approach, traders can strengthen their probability of success while utilizing the range filter indicator to its full potential. As this method evolves and adapts to various market conditions, practitioners can leverage it to support their trading strategies effectively.

Enhancing Your Strategy with Additional Indicators

The effectiveness of the range filter indicator in trading can be significantly improved when it is combined with other technical indicators. By integrating additional indicators such as the Liquidity Weighted Moving Average (LWMA) and the Moving Average Convergence Divergence (MACD), traders can enhance their overall trading strategy and decision-making process. These complementary indicators provide broader market context and improve the accuracy of trading signals.

The Liquidity Weighted Moving Average (LWMA) is particularly useful for gauging market trends while accounting for trading volume. Unlike traditional moving averages that may not properly reflect the influx of capital in different market conditions, LWMA adjusts its calculation based on liquidity, thus providing a more robust perspective. When used in conjunction with the range filter indicator, LWMA can help traders identify potential entry and exit points more effectively. For example, if the range filter signal indicates a potential breakout while the LWMA suggests strengthening liquidity in the same direction, the confidence in the trade is notably heightened.

On the other hand, the Moving Average Convergence Divergence (MACD) serves as a momentum indicator that can signal upcoming changes in the market trend. By tracking the relationship between two moving averages, the MACD assists traders in identifying bullish or bearish momentum. When combined with the range filter indicator, which offers visual support for the prevailing range, the signals generated become more reliable. A situation where MACD shows a bullish crossover in conjunction with a range filter breakout could represent a high-probability trading opportunity.

Incorporating these indicators not only enriches the trading strategy but also fosters a more nuanced understanding of market dynamics. By diversifying the tools available to traders, the chances of successfully navigating the financial markets can be significantly increased.

Combined Strategy for Long Trades

Implementing a combined strategy for long trades involves several critical conditions that traders must monitor to optimize their chances of success. The first step is identifying a bullish trend; it is essential that the market shows signs of upward movement. This can be determined by analyzing price action and recognizing patterns that indicate momentum strengthening in a particular direction.

To confirm buy signals, traders should consider using additional indicators alongside the range filter. One common approach is to utilize moving averages, such as the 50-day or 200-day moving average, which can act as dynamic support levels during a bullish phase. When the price is consistently above these averages, it reinforces the notion that the market is in an upward trajectory, providing a stronger basis for entry. Coupled with the range filter, these indicators can collectively validate bullish sentiments.

Furthermore, it is crucial to ensure bullish momentum before entering a long trade. Traders can assess momentum using oscillators like the Relative Strength Index (RSI) or the Stochastic Oscillator. An RSI value above 50 typically suggests that bullish momentum is intact, while a Stochastic Oscillator reading above 80 indicates overbought conditions, hinting at potential pullbacks. It is vital to weigh these momentum signals, confirming that they align with the primary bullish trend identified earlier.

Another important aspect is to wait for a secure candle close before executing the trade. This means that upon reaching predefined resistance or after generating a buy signal, traders should look for a finalizing candlestick formation that holds above significant support levels. A confirmed candle close facilitates higher confidence in the continuation of the trend, ensuring that traders are not prematurely entering into positions. Adopting this combined strategy can increase the likelihood of successfully capitalizing on long trades within a bullish market environment.

Combined Strategy for Short Trades

Executing short trades effectively requires a thorough understanding of bearish market conditions, which can be accurately assessed using the Range Filter Indicator. Identifying a bearish trend is the first critical step in this process. Traders should look for lower highs and lower lows on their price charts, reflecting consistent downward movement. The Range Filter Indicator can serve as a guiding tool by indicating when price movements fall below a specified range, highlighting potential shorting opportunities.

Once a bearish trend has been established, it’s essential to confirm sell signals. This confirmation can be drawn from several sources, including price action, volume analysis, and additional technical indicators. A trustworthy sell signal often appears when price breaks below significant supports or moving averages. The Range Filter Indicator should ideally signal a bearish condition in conjunction with these occurrences to enhance the accuracy of the short trade setup.

Recognizing bearish momentum is paramount for the successful execution of short trades. A clear understanding of momentum can be gained through various indicators, such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD). When these indicators reflect strong bearish momentum, combined with confirmation from the Range Filter Indicator, traders can feel more confident in proceeding with their short positions.

Moreover, it is imperative to wait for candle closures before executing a trade. This practice helps avoid potential false breakouts that might mislead traders into initiating positions prematurely. By waiting for a complete candle formation, traders can ensure that the market has indeed confirmed the bearish sentiment, thereby minimizing risks associated with sudden price reversals. Overall, the integration of these strategies allows for a more disciplined approach to executing short trades while leveraging the insights provided by the Range Filter Indicator.

Risk Management Techniques

Risk management is a critical component of effective trading strategies, enabling traders to protect their investments and improve their chances of success. Understanding the potential risks involved in trading is essential, as even experienced traders encounter market volatility. One primary method to mitigate risk is through the use of stop-loss orders. These orders provide a safety net, automatically closing a trade when the asset price hits a predetermined level. This mechanism helps limit potential losses, ensuring that no single trade can significantly impact overall capital.

When setting stop-loss levels, it is advisable to base these on recent swing highs and lows. For instance, placing a stop-loss just below a recent swing low when taking a long position can safeguard against sudden price declines. Conversely, for short positions, placing a stop-loss just above a recent swing high can help protect against unexpected rallies. This strategic placement allows traders to remain in the market while still having a robust risk management framework.

Additionally, traders should consider the importance of position sizing as part of their overall risk management strategy. By determining the appropriate amount of capital to risk on each trade, it is possible to manage exposure effectively. A common guideline suggests risking no more than 1% to 2% of total trading capital on any single trade. This approach helps in maintaining discipline and reduces the likelihood of substantial losses that can arise during periods of market instability.

Integrating effective risk management techniques, including the use of stop-loss orders and mindful position sizing, enhances traders’ ability to navigate the complexities of the market. By doing so, traders can foster a stable trading environment, which is crucial for achieving long-term success in the ever-evolving landscape of financial markets.

Adapting to Market Conditions

In the dynamic world of trading, adaptability is an essential trait for success. Market conditions are inherently variable, influenced by numerous factors such as economic data, geopolitical events, and investor sentiment. For traders, this means that relying on fixed strategies could result in missed opportunities or increased losses. To navigate these fluctuations effectively, it is crucial to continuously assess market conditions and adjust one’s approach accordingly.

The Range Filter Indicator serves as a valuable tool in this regard. By analyzing price movements within a defined range, traders can identify potential entry and exit points. However, the effectiveness of the range filter can be significantly enhanced when used in conjunction with other indicators such as the Linear Weighted Moving Average (LWMA) and the Moving Average Convergence Divergence (MACD). By understanding how these indicators interact with current market trends and volatility, traders can make more informed decisions.

For instance, during a trending market, the range filter may indicate a continuation pattern, suggesting that traders should align their trades with the prevailing direction. Conversely, in a choppy or sideways market, relying solely on the range filter may lead to false signals. In such cases, integrating the insights from the LWMA can help traders identify the overall trend, while MACD can be used to gauge momentum. Together, these indicators empower traders to adapt their strategies in response to market fluctuations.

Moreover, maintaining flexibility in one’s trading strategy allows traders to capitalize on various market conditions. For example, when volatility spikes, adjustments to risk management protocols become necessary to protect against sudden price swings. By remaining attentive to shifts in market behavior and modifying the use of indicators like the Range Filter, LWMA, and MACD, traders can enhance their performance and achieve their financial objectives more effectively.

Common Pitfalls to Avoid

Utilizing the range filter indicator can significantly enhance trading strategies, yet traders often encounter common pitfalls that can diminish its effectiveness. One prominent mistake is relying solely on the range filter without considering other technical indicators. While the range filter is designed to highlight price volatility and trends, it functions best in conjunction with complementary tools such as trend lines and moving averages. Ignoring this holistic approach may lead traders to form misguided conclusions or overlook vital market signals.

Another frequent oversight is misinterpreting the signals generated by the range filter indicator. Traders may jump to conclusions based on minor fluctuations, mistaking them for strong buy or sell signals. This impulsive behavior can result in unnecessary trades and increased transaction costs. It is crucial to analyze the context of the signals, including the market’s overall trend and relevant news events, before making decisions. A considered approach will contribute to more informed trading choices.

In addition, many traders overlook the importance of setting appropriate parameters for the range filter indicator. Every financial market exhibits unique characteristics, and a one-size-fits-all approach is often inadequate. Traders should thoroughly test various parameter settings to determine which align best with their trading style. Failure to customize these settings can lead to misalignment with market conditions, ultimately affecting the accuracy of the signals received.

Lastly, emotional trading is a significant pitfall that can undermine the effectiveness of the range filter indicator. Fear and greed can cloud judgment, prompting traders to deviate from their strategies. Maintaining a disciplined trading plan and adhering to predetermined risk management protocols is essential to navigating the financial markets successfully. By avoiding these common mistakes, traders can leverage the range filter indicator as a powerful tool in their trading arsenal.

Conclusion: Creating a Robust Trading Strategy

In evaluating the elements necessary for developing a robust trading strategy, it is apparent that the integration of multiple indicators can significantly enhance decision-making processes. The range filter indicator, in conjunction with the linear weighted moving average (LWMA) and the moving average convergence divergence (MACD), provides traders with a comprehensive toolkit. Each of these components serves a distinct purpose, collectively contributing to a deeper understanding of the market landscape.

The range filter indicator offers a dynamic approach to identifying potential price movements by filtering out market noise. This can be particularly advantageous in volatile conditions, ensuring that traders capitalize on significant trends rather than reacting to arbitrary price fluctuations. By pairing it with the LWMA, which gives more weight to recent price action, traders can obtain a clearer indication of the prevailing trend, enhancing the reliability of their entry and exit points.

Moreover, incorporating the MACD into the trading strategy allows for the identification of momentum shifts. The convergence and divergence of moving averages serve as a valuable confirmation tool, signaling potential reversals or continuations in market trends. This combinatory approach not only supports more informed trading decisions but also facilitates better risk management practices, as traders can establish more precise stop-loss orders based on improved entry signals.

Ultimately, the importance of continuous learning and adaptation cannot be overstated. The financial markets are inherently dynamic, and traders must remain agile, adjusting their strategies based on new information, market conditions, and personal experiences. By embracing an analytical mindset and consistently reviewing performance outcomes, traders can refine their methods, maximizing their potential for success in a challenging environment. The synthesis of the range filter indicator, LWMA, and MACD represents a step toward creating a more resilient trading strategy.