A Trading Strategy Using the STC and DMI Indicators in the Stock Market.

In this video, we will delve into the details of the trading strategy that combines the STC (Schaff Trend Cycle) and DMI (Directional Movement Index) indicators. These two indicators, when used in conjunction, provide valuable insights into the market trends and help traders identify potential buying and selling opportunities. While it is important to note that no trading strategy is infallible, the video emphasizes the positive outcomes that can be achieved when this particular strategy is implemented effectively.

The STC indicator is a popular tool among traders as it combines the benefits of both the MACD (Moving Average Convergence Divergence) and the Stochastic Oscillator. It aims to identify the cyclical nature of the market and determine the entry and exit points for trades. By analyzing the relationship between the current price and its historical range, the STC indicator generates signals that indicate whether the market is overbought or oversold, thus helping traders make informed decisions.

On the other hand, the DMI indicator is designed to measure the strength and direction of a trend. It consists of two lines, the +DI (Positive Directional Indicator) and -DI (Negative Directional Indicator), which help identify the bullish and bearish trends in the market. By assessing the relationship between these two lines, traders can determine the overall strength of the trend and make appropriate trading decisions.

When these two indicators are used together, traders can benefit from a comprehensive analysis of both the cyclical nature of the market and the strength of the prevailing trend. This combination allows them to identify potential buying opportunities when the market is oversold and the trend is bullish. Similarly, it helps them spot potential selling opportunities when the market is overbought and the trend is bearish.

While the video acknowledges that no strategy can guarantee success in the stock market, it highlights the favorable results that can be achieved when this particular strategy is applied correctly. However, it is important for traders to exercise caution and conduct thorough research before implementing any trading strategy. Market conditions can change rapidly, and it is crucial to stay updated with the latest news and developments that may impact the market.

Furthermore, the video recommends using a broker with zero spreads, such as IC Markets, to minimize the risk of hitting stop-loss orders too soon due to high spreads. High spreads can significantly impact the profitability of trades, especially when using a strategy that relies on precise entry and exit points. By choosing a broker with zero spreads, traders can ensure that their trades are executed at the desired prices without incurring additional costs.

In conclusion, this video provides valuable insights into a trading strategy that combines the STC and DMI indicators. By utilizing these indicators effectively, traders can enhance their decision-making process and potentially capitalize on favorable market conditions. However, it is essential to remember that trading involves risks, and no strategy can guarantee consistent profits. Therefore, it is crucial for traders to exercise caution, conduct thorough research, and stay informed about market developments to make informed trading decisions.

The STC indicator is a widely used technical analysis tool that helps traders identify potential trend reversals in the stock market. Developed by Doug Schaff, the STC indicator combines the concepts of moving averages and momentum oscillators to provide a comprehensive view of the stock’s price action.

One of the key features of the STC indicator is its ability to oscillate between 0 and 100. This range allows traders to gauge the strength of the current trend and identify potential turning points. When the indicator is below 25, it suggests that the stock is oversold, meaning that the price may have fallen too far and is due for a bounce back. This presents an opportunity for traders to enter a long position and profit from the expected upward movement.

Conversely, when the STC indicator moves above 75, it indicates that the stock is overbought. This means that the price has risen too high and is likely to experience a pullback. Traders can use this signal as an opportunity to sell their positions or even consider shorting the stock, expecting a downward movement in the near future.

It is important to note that the STC indicator should not be used in isolation but rather in conjunction with other technical analysis tools. Traders often combine it with trendlines, support and resistance levels, and other indicators to confirm their trading decisions and increase the accuracy of their predictions.

Furthermore, the STC indicator can be customized to suit individual trading styles and preferences. Traders can adjust the parameters of the indicator, such as the length of the moving averages and the sensitivity of the oscillator, to better align with their trading strategies. This flexibility allows traders to adapt the indicator to different timeframes and market conditions, enhancing its effectiveness.

In conclusion, the STC indicator is a valuable tool for traders looking to identify potential trend reversals in the stock market. By combining moving averages and momentum oscillators, it provides a comprehensive view of the stock’s price action and helps traders make informed trading decisions. However, it is important to use the indicator in conjunction with other tools and to customize its parameters to suit individual trading styles.

The DMI Indicator

The second indicator discussed is the DMI (Directional Movement Index) indicator. The DMI indicator consists of three lines: the ADX line, the Plus DI line, and the Minus DI line. The ADX line serves as a measure of the trend strength. When the ADX line is above 20, it suggests that the trend is strong. This is because a higher ADX value indicates that the price is trending, while a lower value suggests that the market is ranging or consolidating. Traders often use the ADX line to determine whether a trend is worth trading or not. For example, if the ADX line is above 20 and rising, it may indicate that the trend is gaining strength and there is potential for profitable trades.

The Plus DI line indicates that the stock is in an uptrend when it is above the Minus DI line. The Plus DI line measures the strength of the buying pressure in the market. When the Plus DI line is above the Minus DI line, it suggests that buyers are in control and the stock is likely to continue its upward movement. Traders often look for crossover signals between the Plus DI and Minus DI lines to identify potential entry or exit points. For example, if the Plus DI line crosses above the Minus DI line, it may signal a bullish trend reversal or a continuation of an existing uptrend.

Conversely, the Minus DI line indicates that the stock is in a downtrend when it is above the Plus DI line. The Minus DI line measures the strength of the selling pressure in the market. When the Minus DI line is above the Plus DI line, it suggests that sellers are in control and the stock is likely to continue its downward movement. Traders often monitor the crossover signals between the Plus DI and Minus DI lines to identify potential short-selling opportunities or to exit long positions. For example, if the Minus DI line crosses above the Plus DI line, it may signal a bearish trend reversal or a continuation of an existing downtrend.

In summary, the DMI indicator provides valuable insights into the strength and direction of a trend. By analyzing the ADX line, Plus DI line, and Minus DI line, traders can make informed decisions about when to enter or exit trades. However, it is important to note that no indicator is foolproof, and it is always recommended to use multiple indicators and confirm signals with other technical analysis tools before making trading decisions.

Buying and Selling Conditions

The video outlines the conditions for buying and selling stocks using the STC and DMI indicators. For buying, the conditions are as follows:

- The STC indicator moves above the 25 level.

- The ADX line is above the 20 level.

- The Plus DI line is above the Minus DI line.

These conditions indicate a favorable buying opportunity. When the STC indicator moves above the 25 level, it suggests that the stock is experiencing positive momentum and may continue to rise in price. The ADX line being above the 20 level indicates that the stock is in a trend, which further supports the buying decision. Additionally, when the Plus DI line is above the Minus DI line, it suggests that the buying pressure is stronger than the selling pressure, indicating a potential increase in stock price.

On the other hand, the conditions for selling are:

- The STC indicator moves below the 75 level.

- The ADX line is above the 20 level.

- The Minus DI line is above the Plus DI line.

These conditions indicate a favorable selling opportunity. When the STC indicator moves below the 75 level, it suggests that the stock’s momentum is weakening and may potentially decline in price. The ADX line being above the 20 level indicates that the stock is still in a trend, which further supports the selling decision. Additionally, when the Minus DI line is above the Plus DI line, it suggests that the selling pressure is stronger than the buying pressure, indicating a potential decrease in stock price.

By following these buying and selling conditions, investors can make informed decisions based on the STC and DMI indicators, increasing their chances of successful trades.

Examples of Buying and Selling Scenarios

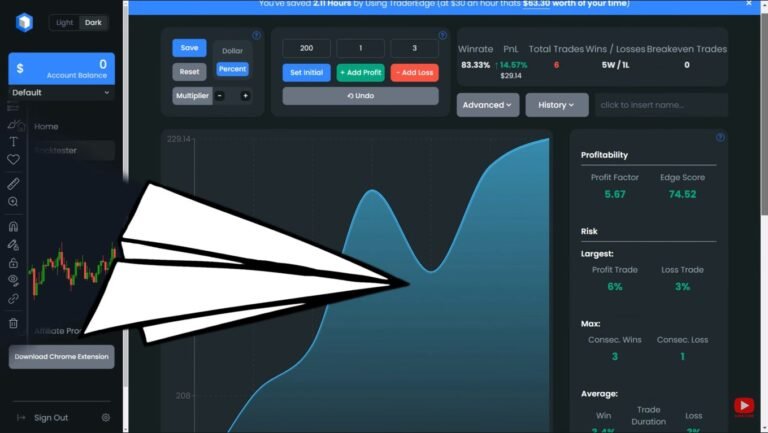

The video concludes by showing examples of buying and selling scenarios using a 30-minute timeframe stock chart. These examples demonstrate how the STC and DMI indicators can be applied to identify potential entry and exit points in the market.

For instance, let’s consider a buying scenario. The STC indicator shows a bullish crossover, indicating a potential uptrend in the stock price. At the same time, the DMI indicator confirms the strength of the trend by showing a strong positive directional movement. Based on these signals, a trader may consider entering a long position, expecting the stock price to continue rising.

On the other hand, a selling scenario could be identified when the STC indicator displays a bearish crossover, suggesting a possible downtrend. Concurrently, the DMI indicator shows a significant negative directional movement, indicating a strong selling pressure in the market. In this case, a trader might consider selling their position or even shorting the stock, anticipating a further decline in its price.

Overall, this video provides insights into a trading strategy that combines the STC and DMI indicators to identify buying and selling opportunities in the stock market. While it is important to remember that no strategy is foolproof, understanding these indicators and their associated conditions can be valuable for traders looking to make informed decisions.